Rail Division

FESCO is one of Russia’s major rolling stock operators boasting own technical and repair facilities servicing its railcar fleet. The Rail Division offers a wide array of transportation and logistics services such as transporting general cargoes in box cars, renting out own rolling stock to transport cargoes across Russia, the CIS and Baltic states, as well as locomotive leasing and services of the network of inland terminals in Tomsk, Khabarovsk and Novosibirsk. In 2019, the Division also provided grain transportation in specialised grain hoppers.

In 2019, the cargo load of Russian Railways’ network went down by 0.9% YoY to 1.28 mt. The volumes began to decrease in mid-2019 on the back of a decline in shipments of ferrous metals and grain, lower prices for Russian coal, and a bigger share of oil products transported by pipeline. Rail cargo turnover (measured in tkm) went up by 0.2% due to a change in the supply chains (bigger trip length).

Box cars

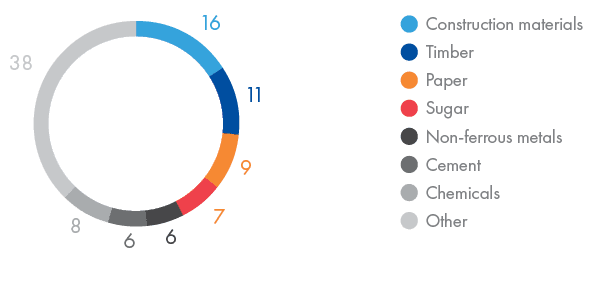

Box cars are universal rolling stock, meaning they are fit to haul a variety of cargo types.

Box car transportation displays the following trends:

- reduced empty run ratio;

- more consignors using box cars (up 19% YoY in 2019);

- expanded fleet of box cars with a higher capacity (158 cu m) across the cargo base of railcars. The key box car models have the capacities of 120, 138 or 158 cu m. Given the same tonnage and cargo base, the railcars designed to transport cargoes with larger cubic volume enjoy higher demand;

- enhanced box car turnaround, up 7% YoY thanks to better logistics schemes and an increased share of full train shipments;

- switch from gondola cars to box cars. Given the wide use of gondola cars for coal transportation, some consignors switched to box cars for chalk, gypsum slabs and bricks. However, the situation may reverse if the trend towards a surplus of gondola cars persists;

- changes in regulations and tariff policy. At the end of 2019, Russian Railways and SRO Union of Railway Operators Market supported the unification of empty run tariffs for box cars and approved the transportation of certain food cargoes using universal rolling stock.

For box cars, the transportation geography did not change much, with 53% delivered domestically, 33% exported (mainly to the CIS countries), 9% imported, and 5% going to transit routes.

Despite a decline in cargo load, the rolling stock production saw higher demand. Over the period of twelve months, more than 3,000 large-volume box cars were manufactured, and more than ten new companies entered the box car transportation market. In 2019, factoring in the sale of cars to the CIS countries and write-offs at the end of the service life, the railcar fleet grew by 1%, and the capacity improved by 2% to almost 7,000 cu m.

The overall decrease in transportation volumes did not affect box car transportation margins, because some large consignors faced a shortage of railcars for their loading needs at various locations and had to lease. The lease rate remained high throughout the year. According to the Company’s calculations, the average exceeded RUB 1,800 per day, up 26% YoY. The high level of rates is also supported by expectations that up to 35% of the existing box cars will be written off by 2027.

Grain hoppers

The volume of transportation in grain hoppers went down, which led to a surplus of railcars and their use for non-core purposes.

Transportation volume

Rail cargo load decreased to 44 mt (down 2% YoY) due to a 3.5 mt reduction in wheat export. This was driven by changes in prices for Russian grain on international markets, which caused the bulk of shipments of the 2020/2019 harvest to shift to Q1 2020.

As at the beginning of 2019, there were around 45,300 railcars on the market. The demand for new grain hoppers surged, as the service life of 13,000 railcars would expire within the next three years. Operators received over 8,600 new railcars during the year. At the end of the year, the number of railcars (including write-offs) increased by 10.3%

The main trend of 2019 was the consolidation of the grain hopper market. Five major companies increased their railcar fleets to 38,700 or 76% of the market in 2019, with the largest one accounting for 50% of the market.

Use of grain hoppers for non-core purposes

In 2019, grain hopper surplus resulted in these railcars being used for transporting non-core cargoes (cement, chemical and mineral fertilisers). Usually these are railcars whose useful life is coming to an end. In 2019, their share rose by 9%, reaching 34% of the fleet.

The Rail Division includes rolling stock owners and operators: Transgarant, Russkaya Troyka and Trans-GrainIn February 2020, a 100% stake in Trans-Grain was sold., along with Stroyopttorg (an inland terminal in Khabarovsk) and TG-Terminal.

The Rail Division runs several types of target rolling stock: fitting platforms for container transportation, specialised grain hoppers The fleet of grain hoppers was sold in 2020., and universal box cars.

| Indicator, units | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2019 |

|---|---|---|---|---|

| Fitting platforms | 3,593 | 4,457 | 5,593 | 6,296Operated by the Liner and Logistics Division. |

| Grain hoppers | – | 2,931 | 4,069 | 4,203 |

| Box cars | 1,639 | 1,515 | 1,244 | 2,047 |

| Other | 1,333 | 381 | 300 | 177 |

| Gondola cars | 6,248 | 2,109 | 709 | – |

| Pellet hoppers | 1,698 | 1,576 | 10 | – |

FESCO is the second largest operator of fitting platforms on the market. The Company’s market share in terms of box cars and grain hoppers is 4% and 8%, respectively.

In 2019, a two-year large-scale swap programme came to an end. As a result, all other types of rolling stock (except for fitting platforms, grain hoppers and box cars) were classified as non-core assets. Over 6,000 gondola cars, more than 1,500 pellet hoppers and over 1,000 other railcars were sold. The sale enabled the Company to purchase fitting platforms and box cars on the secondary market, build new railcars (including advanced high-capacity railcars boasting longer repair intervals), and acquire a controlling stake in Russkaya Troyka. The fleets of fitting platforms and box cars added 703 units (including 450 leased units) and 803 units, respectively. As at 31 December 2019, the Rail Division operated a total of 12,723 units of rolling stock.

Grain segment

In 2019, FESCO resolved to exit the grain cargo transportation segment by selling Trans-Grain and its existing fleet of grain hoppers. The reason was poor macroeconomic environment in Q1 2019 brought about by the grain hopper surplus on the Russian Railways network and industry consolidation trends. At the time of the resolution, the grain hopper fleet comprised 4,203 units, including 2,338 leased railcars. In 2019, FESCO also entered into a preliminary sales and purchase agreement, intending to complete the transaction in 2020 and use the resulting funds to reduce its debt and invest in core assets and digital technologies for the sake of better service quality.

Inland terminals

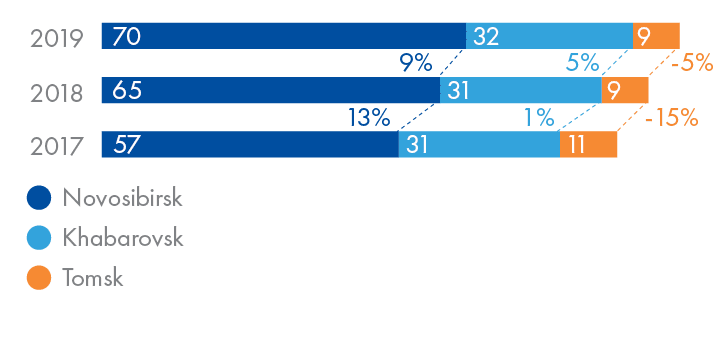

The Rail Division’s assets include inland container terminals in Khabarovsk, Novosibirsk and Tomsk, which are the key links in the FESCO intermodal transportation chain.

| Terminals | Novosibirsk | Khabarovsk | Tomsk |

|---|---|---|---|

| Total area, ha | 15.7 | 9.2 | 0.6 |

| Container storage area, ha | 1.7 | 1.6 | 0.6 |

| Container storage capacity, TEU | 1,300 | 2,350 | 800 |

| Annual container throughput capacity, TEU | 90,000 | 54,000 | 12,960 |

| Container handling in 2019, TEU | 72,822 | 35,927 | 8,730 |

The container terminal in Novosibirsk is located near the Novosibirsk-Vostochny rail station and has three railway lines. In 2019, the Company put into operation an additional concrete platform at the terminal, which increased the storage capacity and the area for simultaneous delivery of cars for loading to 71 standard railcars (previously 57 standard railcars). Thus, the volume of handling large-capacity containers increased by 9%. The facility contains a well-developed network of own railway lines and six own shunting locomotives. The terminal services export container trains from Novosibirsk and regular FESCO shuttles from Novosibirsk to Khabarovsk, and its track facilities ensure seamless coal supplies to CHPP No. 4.

The Khabarovsk terminal, one of the largest logistics hubs in the Russian Far East, is the only facility in the region offering a combination of warehousing, freight forwarding and container terminal services. Occupying a total area of 9.3 hectares, the facility lies close to the federal highway running from Khabarovsk to Vladivostok, has access to the Amur River and the Krasnaya Rechka railway station. In 2019, the terminal developed new options to handle and forward containers for export, as well as refrigerated container handling. This helped enhance the container handling and railcar turnover by 5% and 9%, respectively. With an inflow of new customers, the volumes of road transportation and forwarding grew by 24% to 4,934 TEU vs 3,968 TEU in 2018.

The Tomsk terminal is located on the site of Tomskneftekhim (a subsidiary of SIBUR Holding). The terminal is connected to the Trans-Siberian Railway (Kopylovo station) via 305 m long access routes. It carries out its handling operations under a partnership agreement with Tomskneftekhim, which supplies polypropylene and low-density polyethylene to the Russian, FSU and non-FSU markets. The terminal had its spreader upgraded and introduced tank container operations. On top of that, the terminal performs container repairs (particularly welding works).

FESCO’s Rail Division operates a fleet of universal box cars and specialised grain hoppers, offering freight forwarding services, dispatcher control (24/7 monitoring of railcar movement within the network), own train formation technology, locomotive leasing, and railcar storage infrastructure. To deliver excellence in transportation, the Rail Division runs six representative offices in the key cargo base regions: Moscow and the Moscow Region, the Primorye Territory, the Chelyabinsk Region, the Irkutsk Region, and the Komi Republic.

The Rail Division ramps up its fitting platform fleet to integrate FESCO’s assets and the other divisions’ competencies. The Division ensures the technical quality of the fleet and proper maintenance of railcars, optimises repair costs and times by installing its own spare parts and wheel sets.

The Rail Division maintains and develops the infrastructure of inland terminals in Tomsk, Khabarovsk and Novosibirsk, and renders container terminal services, including receiving and dispatching containers, loading and securing cargo in a container, crating, warehouse logistics and responsible storage services.

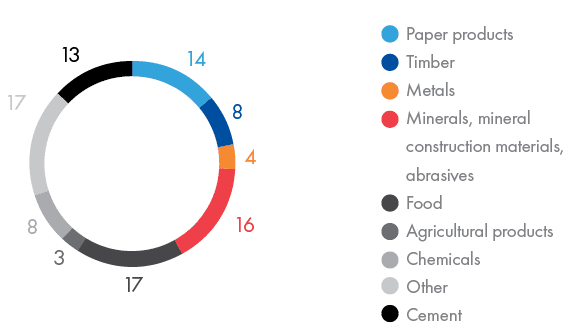

The Rail Division provides services to a wide range of customers by leveraging its universal box car fleet along with grain hoppers.

In 2019, the Company’s premier customers were:

- mining and metals industries: ArcelorMittal Temirtau, NAC;

- construction industry: Serebryakovcement, Novoroscement;

- petrochemical industry: Nizhnekamskneftekhim, SIBUR Holding, Kuchuksulphate;

- timber industry: Swiss Timber International, Mondi Syktyvkar LPK;

- food and agricultural industries: UGC South, Louis Dreyfus Company Vostok, TD RIF, ASTON.

In 2019, railway container transportation volumes rose by 14% to 388 thousand TEU vs 340 thousand TEU in 2018 on the back of the ramp-up of the fitting platform fleet.

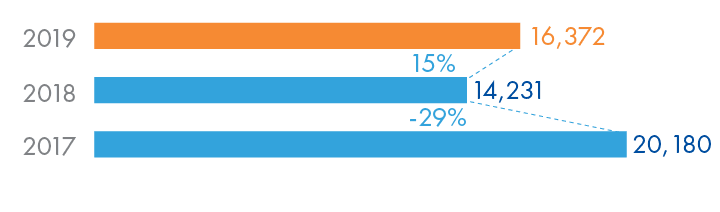

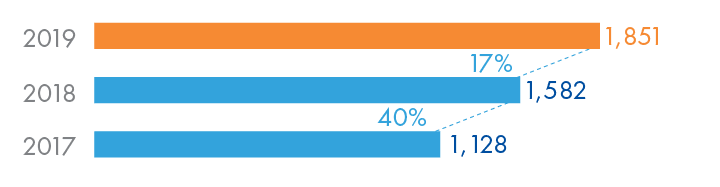

Shipments in box cars grew by 15 % to 16,372 units, with transportation margins up by 17% YoY thanks to new routes.

| Indicators | 2016 | 2017 | 2018 | 2019 | YoY change, % |

|---|---|---|---|---|---|

| Rolling stock, units | 14,511 | 12,969 | 11,925 | 12,723 | 7 |

| Shipments in box cars, units | 17,975 | 20,179 | 14,231 | 16,372 | 15 |

| Rail container transportation, ktEU | 191 | 270 | 340 | 388 | 14 |