Liner and Logistics Division

The Liner and Logistics Division (LLD) integrates the operations of our other divisions and provides customers with door-to-door intermodal transportation services.

- 6,620 fitting platforms;

- 40,301 general-purpose containers;

- 1,839 refrigerated containers;

- 167 tractors and trailers.

Market overview

In early 2019, key economic sectors were expected to see further robust growth against the favourable global backdrop. However, the following serious risks had a negative impact on trade dynamics:

- aggravation of the US-China trade war;

- slowdown in emerging markets;

- delay to the UK’s decision to withdraw from the European Union (Brexit);

- imposition of sanctions on Iran.

In addition, the depreciation of national currencies of Turkey, Brazil and Argentina contributed to an increase in the share of local production (regionalisation). This led to the substitution of imports and changes in international supply chains.

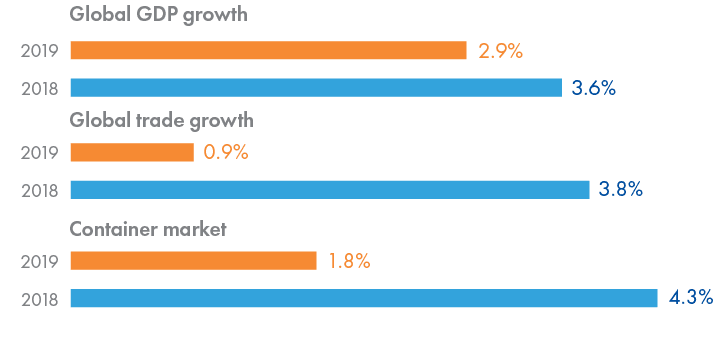

Slower growth rates were seen in global output (up by 2.9% vs 3.6% in 2018 (IMF)) and trade volumes (up by 0.9% vs 3.8% in 2018 (IMF)). These negative developments pulled the growth in the global container market down to 1.8% vs 4.3% in 2018.

Sea shipping margins remained low due to the following factors:

- the three dominant maritime alliances (The Alliance, 2M, and Ocean Alliance) in the Eastern Pacific account for 75.9% of the market (according to IHS). Carriers are finding it increasingly difficult to obtain antimonopoly authorities’ approval for mergers and, as a result, to optimise costs;

- excess tonnage puts pressure on the market, with the global supply of the container fleet and the transportation volumes up by 5.7% and 4%, respectively (data by Alphaliner);

- the need to reduce emissions through the use of low sulphur fuel oil according to IMO 2020 forces carriers to purchase more expensive fuel;

- expansion of global players to local emerging markets;

- standardisation and digitisation of document flow;

- lower production growth in China;

- slowdown in consumption due to shrinking global production and rising inflation;

- placement of large orders for container ships puts pressure on rates;

- slowdown in global trade amid the development of local production and restrictions on imports introduced in a number of countries.

In 2019, the segment’s economic growth amounted to 1.5% of GDP. All key macro indicators, such as Industrial Production, Retail Trade and Capital Investments, demonstrated lower growth rates.

| YoY change | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| GDP | (3.7) | 0.3 | 1.6 | 2.3 | 1.5 |

| Industrial Production | (5.1) | (0.5) | 1.6 | 2.4 | 2.0 |

| Retail Trade | (9.4) | (1.2) | 4.1 | 3.2 | 1.7 |

| Capital Investments | (7.7) | 0.5 | 6.5 | 3.0 | 2.0 |

| USD/RUB exchange rate | 61.0 | 67.0 | 58.0 | 63.0 | 65.0 |

The average annual value of the Consumer Confidence Index plunged below 50.0 pp, while the Business Activity Index fell to 45.6 in December 2019. These indicate the expected negative economic shocks.

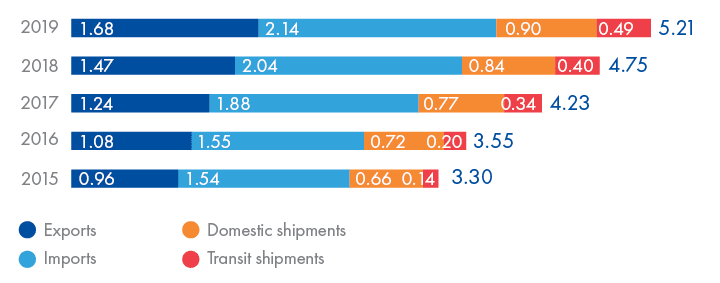

Following the economic slowdown, the growth of container market in Russia subsided as wellThe Russian container market comprises international and transit container handling of Russian ports, international and transit container handling of land border crossings within the Russian Railways network, domestic container transportation across the Russian Railways network, as well as domestic maritime transportation.. The transportation volumes were up by 9.3% vs 12.6% in 2018.

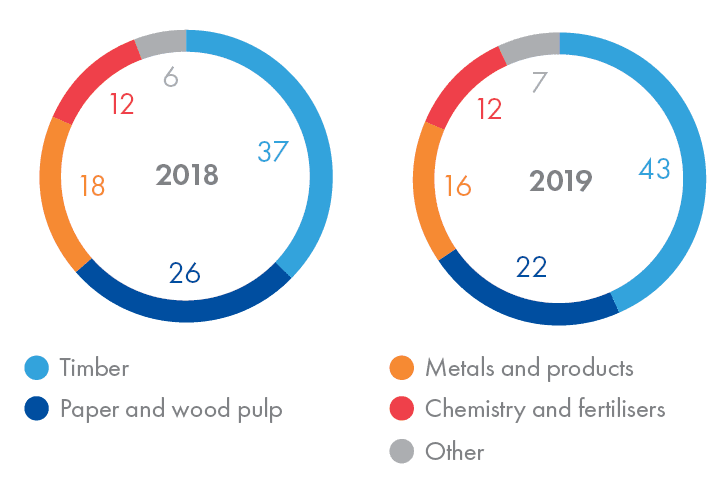

Exports grew by 14% (mainly due to timber products shipped to China). The share of timber in container exports increased to 43% vs 37% in 2018 due to the following factors:

- increased duties on unprocessed timber exports;

- high investment in the industry;

- rouble depreciation;

- subsidies for shipments via land border crossings provided by the Chinese government.

The segment’s growth was also underpinned by the development of container exports of agricultural and food products (included in “Other” below).

Imports increased by 5% to 2.1 million TEU vs 2 million TEU in 2018. Such a marginal growth over the last five years was due to a higher value added tax (VAT) and lack of investment activity, which was only partially compensated by active lending to households and the rouble appreciation against the US dollar.

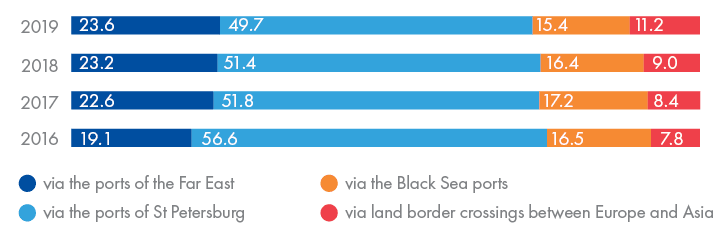

The share of Russia’s Far East in imports went up by 0.4 pp to 23.6% due to deliveries of FMCG, auto parts and cars on routes from China via land border crossings.

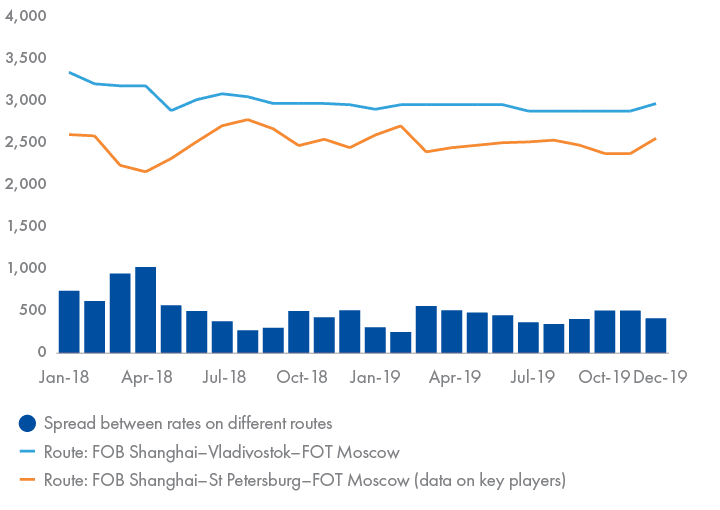

The average cost for importing a 40-foot container on the Shanghai–Far East–Moscow route decreased by USD 147 to USD 2,920 vs USD 3,067 in 2018. The rates for the Deep Sea Route (via the ports of St Petersburg) remained unchanged.

Over the last four years, the segment has enjoyed stable growth. The volume of transportation increased by 7% to 900 thousand TEU vs 841 thousand TEU in 2018. Due to the fact that 55% of quality warehouse facilities in Russia is located in Moscow (according to KnightFrank), it remains a key domestic distribution centre. Two factors contributing to the segment’s growth are the launch of new container train routes between Moscow and other Russian cities and effective competition between container transportation and delivery by road.

The volume of domestic maritime transportation in the Russian Far East went up by 6% to 172 thousand TEU vs 162 thousand TEU in 2018. This growth was mainly driven by infrastructure projects and industrial construction.

Being the smallest segment of the Russian container market in terms of transportation volumes, transit shipments boast the largest annual growth rate. In 2019, the volume of transit rail transportation grew by 21% to 487 thousand TEU vs 402 thousand TEU in 2018. The main direction for transit transportation is from China to Europe and back. The segment’s growth is driven by the better quality of route services via the Trans-Siberian Railway, improved frequency of container train shipments, and subsidies provided by the Chinese government.

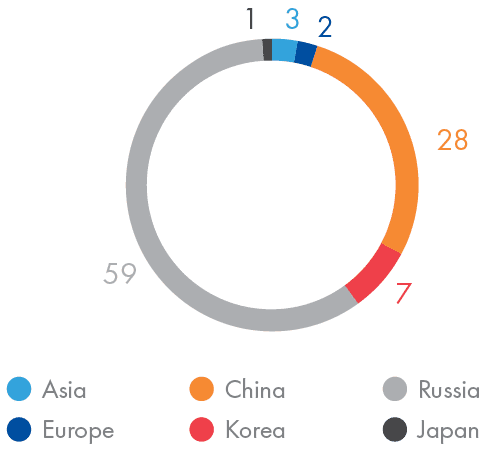

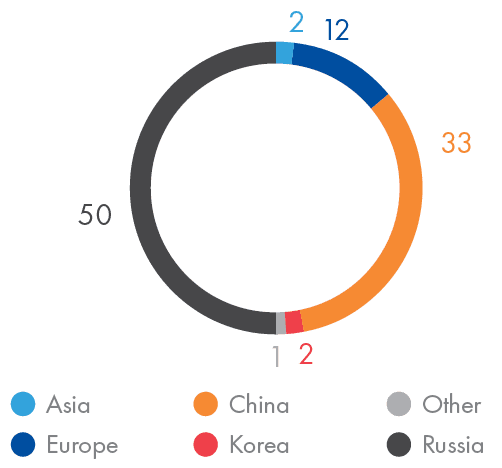

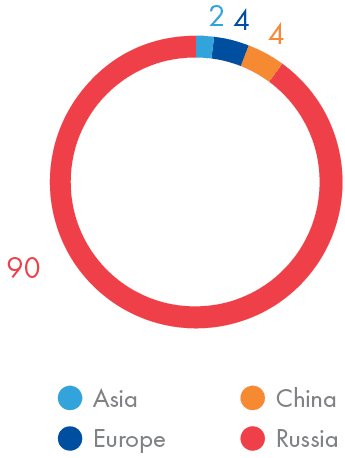

FESCO’s share in the key transportation routes is presented below.

In 2019, Russian railcar manufacturers hit an absolute record for car production, having supplied more than 12 thousand fitting platforms to consumers. As a result, the fleet of specialised rolling stock for container transportation went up by 23% to 68 thousand railcars vs 55 thousand railcars in 2018, including the construction of new railcars and write-offs of old ones.

The high demand for new cars was driven not only by larger transportation volumes, but also by higher business profitability, which is linked to the cost of leasing. The market rate for an 80-foot fitting platform was continuously increasing since 2016 to reach RUB 2,125 per day by mid-2019. In late 2019, the rates started to lose momentum, resulting in an oversupplied market, which indicates a potential surplus.

Through the integration of the Group’s assets under FESCO Integrated Transport (FIT), we continue to hold one of leading positions in Russia’s container transportation market. FESCO’s intermodal transportation offering includes liner shipping, port handling, railway transportation, customs clearance and last mile services. To provide intermodal transportation services, the Company relies on its own and leased assets, such as vessels, containers, fitting platforms, trucks, and terminal and port facilities in Vladivostok, Novosibirsk, Khabarovsk and Tomsk.

FESCO seeks to define quality in the intermodal transportation industry and puts special emphasis on improving customer service to provide full control over deliveries, enable users to view all relevant information at any time, simplify document workflow, and automate interaction between all parties to the transportation process.

FESCO ranks among the liner shipping market leaders carrying cargoes between ports in the Asia-Pacific region and Russia’s Far East. To cement its leading positions, the Company has upgraded its key line services on the routes from China, Korea and Japan to improve traffic frequency and reduce transit time.

The following lines have seen an upgrade on the routes from China and Korea:

- FESCO China Express (FCXP-1 south line) runs between the southern ports of China with a minimum transit time from Shanghai to Vladivostok. The voyages are made on a weekly basis;

- FESCO China Express (FCXP-2 north line) connects the northern ports of China, boasting a minimum transit time from Ningbo to Vladivostok. The shipping frequency is one week;

- FESCO Korea Express (FKXP) was removed from Chinese FCDL line and divided into three direct services with a minimum transit time between Busan–Vladivostok, Vostochny and Korsakov. The voyages are made on a weekly basis;

The new route from Japan operates on a weekly basis (previously, once every two weeks), connecting Russia’s Far Eastern ports with the largest Japanese ports of Sendai, Yokohama, Nagoya, Kobe and Toyama-Shinko.

FESCO is also one of the leading providers of domestic maritime transportation. Its domestic lines connect Vladivostok with Magadan (FML), Sakhalin (FKDL), Petropavlovsk-Kamchatsky (FPKL) and Chukotka (FADL). A new FKL line was launched between Vladivostok and Kunashir, Shikotan, and Iturup. The shipping frequency is once every two weeks. To ensure enough capacity for the FML line, the Group purchased FESCO Magadan and FESCO Moneron container ships.

The Liner and Logistics Division runs regularly scheduled container trains using its own and leased fitting platforms. This service is regarded as one of the most promising priority business lines due to the continuous growth of cargo containerisation.

The division has dispatched over 1.4 thousand container trains from Vladivostok Port, reaching an all-time high of 34 trains in one week.

To optimise empty runs and expand the rail transportation coverage, FESCO has resumed St Petersburg–Vladivostok container train service (shipments dispatched from the St Petersburg–Tovarny–Finlyandsky railway station) and rolled out new services:

- FESCO Ural Baltic Shuttle from Yekaterinburg to St Petersburg;

- FESCO Ural Baltic Siberia Shuttle from St Petersburg to Novosibirsk;

- FESCO Primorye Shuttle from Krasnoyarsk to Beijing via land border crossings.

The market share of FESCO across the East–West and the West–East corridor gained 2% vs 2018 thanks to improved frequency of shipments, better quality of services and expanded railway geography.

FESCO is actively developing transit transportation from Asia to Europe and back. The first FESCO Silk Way container train travelled along the China–Europe–China land route spanning more than 10 thousand km with several border crossings. Shipments dispatched from Zhengzhou (China) arrived to Poland and Germany in 13 and 15 days respectively, or three times faster than if delivered through the Suez Canal. The reverse route took 18 days. This initiative was part of cooperation between FESCO and Zhengzhou International Hub (ZIH), a Chinese state-owned logistics operator specialising on the routes through Henan Province, as well as on trading of food and agricultural products, and wine and spirits.

To increase transit volumes from Korea and Japan, FESCO has signed agreements with Russian and Korean logistics companies, namely RZD Logistics and UNICO LOGISTICS CO.

The Company has launched a land service between China and Germany to transport transit cargoes via Kaliningrad FESCO Silkway Amber. The route goes through the Erlian (China) – Zamyn-Üüd (Mongolia) – Naushki (Russia) and Mamonovo (Russia) – Branevo (Poland) border crossings. Cargoes are transshipped to the 1,435 mm gauge trains at the Dzerzhinskaya-Novaya station (the Kaliningrad Region). The total transit time is 14 days. The freight traffic mostly consists of consumer goods and equipment.

To expand the geography of land export services, FESCO has launched a regular container train from the Khabarovsk Territory to Harbin (China) through the border crossing of Grodekovo (the Primorye Territory) – Suifenhe (China). The total travel time is 10 days. The timber processing industry is a key freight traffic generator.

FESCO’s share of export train shipments from Siberia to China via Mongolia added 2%.

FESCO delivers door-to-door intermodal transportation services by combining two or more modes of transport, such as domestic and international maritime transportation, rail transportation, or road transportation by truck. To streamline the process, FESCO provides its customers with a possibility to deliver containerised cargo under a single bill of lading, submit transportation requests and track cargo online via MY.FESCO.

Launched by FESCO in 2017, the project called From Shanghai to Moscow in 20 days helped reduce the average transit time from 44 to 24 days thanks to detailed analysis of business processes and their upgrade. This experience allowed FESCO to further develop expedited delivery services. To implement FESCO Fast Forward, the Group has

- updated the personal account’s functionality;

- optimised liner shipping services;

- launched a joint project with Russian Railways called INTERTRAN, which provides for electronic execution of intermodal transportation documents;

- increased the frequency of container trains’ shipments;

- established electronic workflow with customers;

- launched the Service Excellence project to monitor the performance of indicators directly linked to the service quality;

- optimised internal business processes.

These efforts helped reduce total transit time and improve service quality. Today, more than 40% of cargoes are delivered to Moscow within 15–20 days.

In addition to the expedited delivery on the route Shanghai–Moscow, FESCO offers the following services:

- expedited cargo delivery from Japan to Moscow (the Hayamichi project);

- expedited cargo delivery from Korea to Moscow (the Ji-Rum-Gil project).

The FESCO Fast Forward solution served as an impetus to create a Trans-Siberian Landbridge service featuring routes from Japan and Korea to Europe together with RZD Logistics. In May 2019, a joint transit service was launched for expedited delivery of cargoes from Japan to Europe via Russia’s Far East using the Trans-Siberian Railway. In June 2019, the first container train was dispatched from Busan (Korea) via Vladivostok along the Trans-Siberian Railway to Brest and then to a warehouse in Poland. The total transit time was 21 days, which is twice as fast as a sea route through Suez Canal.

After a series of successful dispatches of trains from Asia to Europe, October 2019 saw the first container train running along the reverse route (Europe–Brest–Vladivostok–Japan). This is how the reverse service Trans-Siberian LandBridge Eastbound was launched.

Customers

The division’s well-diversified customer portfolio includes:

- major global players: Woojin Global Logistics, Zhengzhou International Hub, DHL, UNICO LOGISTICS, Swift Transport International Logistics, DSV Group, TOYO TRANS INC;

- Russian freight forwarding companies: VL Logistic, Fares, TIS-Logistic, KLM-Logistic;

- freight owners:

- retail networks: Magnit (Tander), Kari, Sportmaster,

- timber industry: Lesosibirsky LDK No. 1, Ilim Group,

- petrochemical and oil refining industries: SIBUR Holding,

- metals industry: RUSAL.

For over five years, FESCO has been the most trusted cargo and freight shipper for the top 15 largest customers accounting for 24% of the division’s turnover. Glovis, the exclusive logistics operator of Hyundai, has entered into cooperation with FESCO in 2019 to became one of the Group’s key partners. In addition to Glovis, 48 other companies have chosen FESCO as a provider of intermodal services.

Services

FESCO is the only company involved in the refrigerated transportation of perishable goods requiring special temperature conditions, which uses its own assets on international and domestic routes: sea, rail and road transport, as well as carrier- and shipper owned containers. Refrigerated container transportation is carried out by Dalreftrans on the basis of the Liner and Logistics Division.

Market overview

The share of refrigerated transportation increased by 5% to 58 thousand TEU vs 55 thousand TEU in 2018. The segment undergoes the process of containerisation. In total refrigerated transportation volume, the share of refrigerated container transportation across the Russian Railways network grew by 3% to 26% vs 23% in 2018. The share of Dalreftrans in total shipments across the Russian Railways network was 21%.

Key industry trends:

- exports of livestock products from Russia encourages the development of cross-border refrigerated transportation by container trains;

- depreciation and disposal of diesel generator cars drives market participants either to renew the fleet or to switch to new technologies, including the acquisition of autonomous mounted diesel generator sets (jensets), which requires substantial investment;

- softening of rules for railroad freight transportation simplifies the process of tapping the market for new players, however, the initial investment threshold remains very high;

- the programme to develop rail shipments of perishable goods announced by Maersk and the company’s investment in its own warehouse infrastructure will drive competition in the market.

Customers

Dalreftrans’ key customers are fish and fish processing companies, fruit and vegetable traders, food exporters and importers. When building its customer portfolio, the company focused on international multimodal transportation from the ports of China to Siberia, Primorye Territory and the Central Federal District.

Services

3PL (third-party logistics) providers offer a full range of logistics services. 3PL is one of the fastest growing areas of FESCO’s logistics business. The Company has launched less-than-container-load (LCL) deliveries and started to engage FESCO Integrated Transport in the preparation of internal customs transit documentation. In addition, FESCO offers the following 3PL services to its customers:

- transportation management;

- accounting and inventory management;

- preparation of import, export, and freight documentation;

- warehousing and cargo handling;

- delivery to end customers;

- maintenance of special equipment, assembly of loaders and excavators;

- customs brokerage services;

- delivery by air.

Market overview

There are both opportunities and constraints for the 3PL market in Russia.

Growth opportunities:

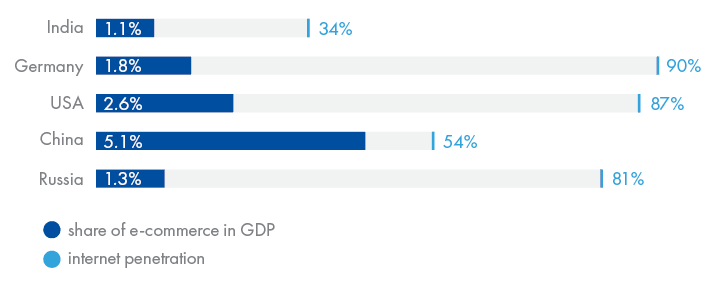

- e-commerce development. In 2019, the share of e-commerce in Russia’s stood at 1.3%, with further growth potential and a high internet penetration rate of 81% (according to Data Insight);

- automation of logistic processes. The sector’s players are actively automating customs clearance processes, introducing electronic workflow and embracing cloud technology to improve the efficiency of the above processes even further.

Constraints:

- lack of quality warehouse facilities in the Russian regions. In 2019, there were 27.2 million sq m of quality warehousing facilities in Russia, including 70% in the Moscow agglomeration and in St Petersburg / the Leningrad Region (according to KnightFrank);

- slow transition to 3PL outsourcing. Its share amounts to 40–50% globally vs 20–25% in Russia (according to the Company data);

- poor quality of road infrastructure. By late 2018, the share of regional and local roads meeting regulatory requirements was below 60% and 50% respectively (according to Rosstat).

Customers

2019 saw the number of customers who had ever used 3PL complex services go up by 40%. This mainly includes direct customers – representatives of retail and industrial companies such as Askona Trading House, Liebherr-Russland, Razrez Mayrykhsky Management Company, Vostochnaya Technica (the official dealer of Caterpillar), and Melon Fashion Group.

Services

FESCO offers turnkey project transportation of bulky and heavyweight cargoes: from receipt at the manufacturing plant to installation at the destination point. Transportation is fully compliant with the regulatory requirements for the transit of cargo along the route, including border crossings. The project logistic services include:

- engineering and construction support of transport and logistics projects;

- handling of bulky cargo;

- transportation of bulky cargo by sea and river transport;

- transportation of bulky cargo by specialised vehicles;

- transportation of bulky pieces equipment by rail;

- delivery of oversize and heavyweight cargoes by any means of transport;

- customs support;

- installation and assembly of cargoes in their designed position at the destination point.

Over 200 thousand freight tonnes of bulky cargoes were transported in 2019, including:

- transportation of nine nuclear submarine units and a tanker from the Kamchatka Territory to their disposal site in the Primorye Territory;

- transportation of oversized equipment for a coal terminal under construction in Port of Vanino;

- transportation of four Liebherr rubber tyre gantry (RTG) cranes from St Petersburg to the Far East of Russia;

- transportation of equipment (including oversized) from Europe to the plant under construction in Gubakha (the Perm Territory);

- equipment for the construction of a thermal power plant in Nizhnekamsk;

- equipment for the construction of the Rooppur Nuclear Power Plant in Bangladesh.

Market overview

The global demand for project logistics services is growing on the back of the following:

- construction of infrastructure for the development of recently discovered large oil and gas fields in the Arctic;

- the development of the Northern Sea Route infrastructure for exploration and mining, and for transit transportation;

- the growing demand for liquefied natural gas fostered the construction of plants and terminals to receive, store and process this type of hydrocarbon worldwide;

- booming renewable energy projects, which pushes up demand for construction of renewable power generation plants.

Despite the slowdown in Russia’s investment growth (up 2% vs 3% in 2018), 2019 saw the following positive trends in the project logistics development:

- growth in the number of projects in the oil and gas and energy sectors in the CIS and Transcaucasia, mainly in Uzbekistan, Turkmenistan, Kazakhstan, and Azerbaijan;

- creation of international alliances and pools in the field of project cargo transportation by sea, which allows combining expertise to tackle complex project tasks;

- government support for major infrastructure projects, such as construction of bridges, tunnels, ports, and terminals;

- creation of a market niche for specialised engineering services involving horizontal and vertical movement of cargo with complex equipment;

- the growing number of mergers and acquisitions between project forwarders and 3PL operators, which helps to improve expertise in providing project logistics services.

Customers

In 2019, project logistics services were used by 17 customers, of them 11 were new. 11 countries, including Russia, China, Romania, and Bangladesh, served as departure points. Customers included RosRAO, Zuest & Bachmeier Project GmbH, Atomstroyexport, and Kuhne+Nagel.

FESCO offers short-distance first and last mile deliveries of containerised cargo by road from terminals to customers. The fleet is consolidated on the basis of FESCO TRANS, which uses its own and outsourced trucks in Moscow, Vladivostok, St Petersburg, Khabarovsk and other Russian cities.

FESCO provides the following shipping agency services:

- arrival/departure of Russian and international vessels;

- electronic workflow with customs authorities;

- supply of ships with fuel, water, food, and spare parts;

- ship repair;

- mooring/unmooring of ships;

- cargo operations;

- crew change.

Since China is a key strategic market for FESCO, there are three full-fledged companies based in China with a wide portfolio of logistics services for destinations popular with Chinese customers. The companies’ offices are located in Shanghai, Beijing, Guangzhou, Tianjin, Ningbo, Qingdao, Dalian, Xiamen, and Chongqing. With its own representative offices in China, FESCO is well-poised to sell its transport solutions to direct shippers. In 2019, FESCO companies in China employed 125 people who organised forwarding and transportation of 267 thousand TEU and 213 tonnes of air cargoes, including:

- transportation between China, Russia, and Europe via land routes;

- imports of perishables to China;

- international LCL deliveries by FESCO’s own service from China to Russia.

With these services currently booming, FESCO plans to see a several-fold increase in volumes going forward.

In 2019, the Group reached all-time highs capturing 46% of the intermodal transportation market across the East–West corridor, up 7 pp YoY. The volume of intermodal transportation went up by 14% to 344 thousand TEU vs 302 thousand TEU in 2018 thanks to the launch of new services, the Group’s flexible commercial policies, and automation of logistics.

International maritime transportation slid to 250 thousand TEU (down 20% YoY) vs 313 thousand TEU in 2018 following the decision taken in late 2018 to cut transportation volumes at the Baltic lines.

Domestic maritime transportation fell to 78 thousand TEU (down 2% YoY) vs 79 thousand TEU in 2018.

| Indicator, ktEU | 2016 | 2017 | 2018 | 2019 | YoY change, % |

|---|---|---|---|---|---|

| Intermodal transportation | 165 | 244 | 302 | 344 | 14 |

| International maritime transportation | 257 | 319 | 313 | 250 | (20) |

| Domestic maritime transportation | 59 | 67 | 79 | 78 | (2) |