Port Division

Commercial Port of Vladivostok (VMTP) is the largest stevedore in Russia’s Far East and a critical link in FESCO’s logistics value chain, enabling the Company to provide intermodal transportation services to customers.

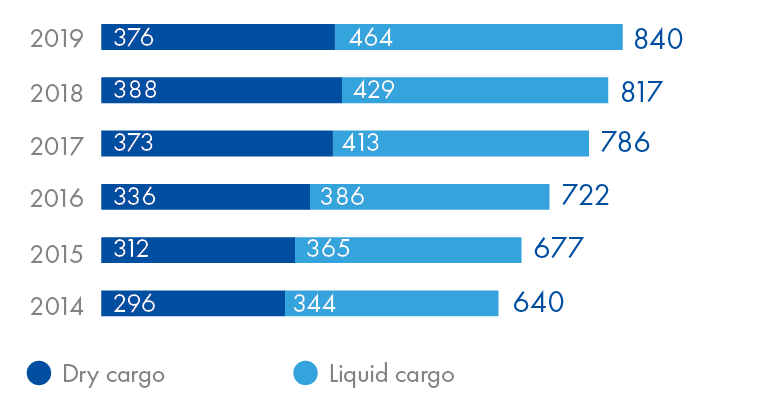

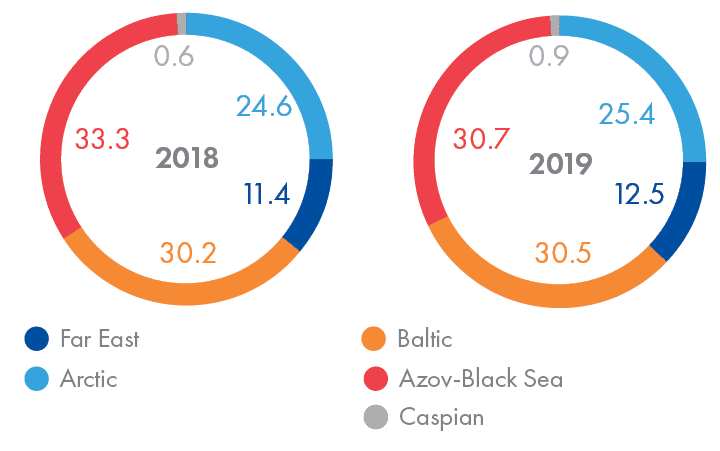

In 2019, the cargo handling of the Russian sea ports reached yet another all-time high of 840 mt, growing 2.9% from 817 mt in 2018. The national stevedoring industry has been expanding since the late 1990s, and handling volumes have increased by 31% since 2014.

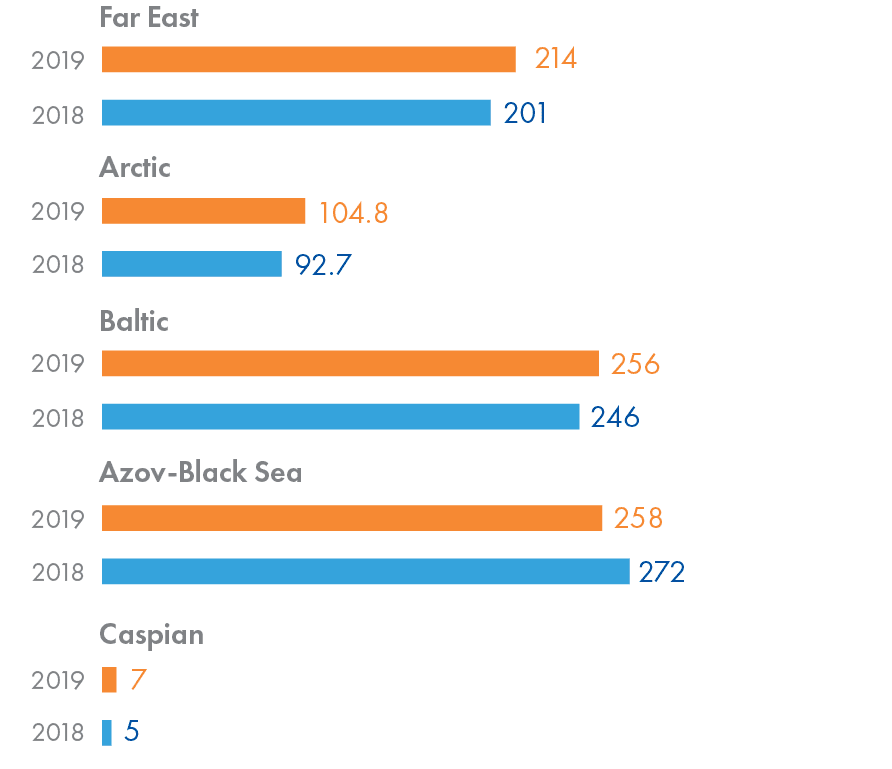

In 2019, the share of the Far East Basin, FESCO’s key region of operations, in the total cargo throughput of the Russian ports increased to 25.4% compared to 24.6% in 2018. The basin demonstrated the highest throughput growth of 6.5%, an increase from 200 mt in 2018 to 213.5 mt, including 135.3 mt of dry cargoes and 78.2 mt of liquid cargoes.

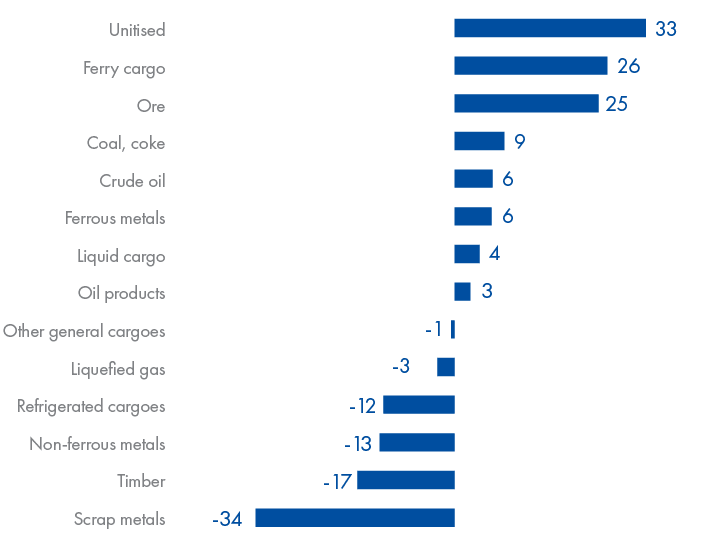

Dry cargo

Handling of dry cargoes amounted to 135 mt (+7.8%) of the Far East Basin’s total turnover. The growth primarily came from unitised cargo, ferry cargo, ore and coal. Timber and scrap metal demonstrated the biggest decline.

Containerised cargo

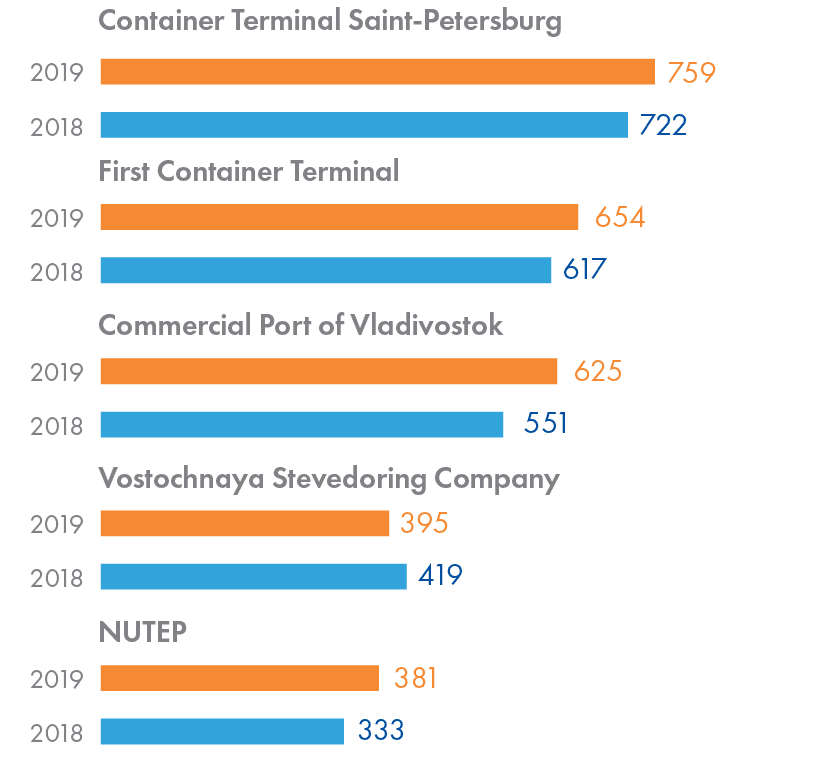

VMTP has strengthened its position in the Top 3 leading Russian stevedoring companies by container handling.

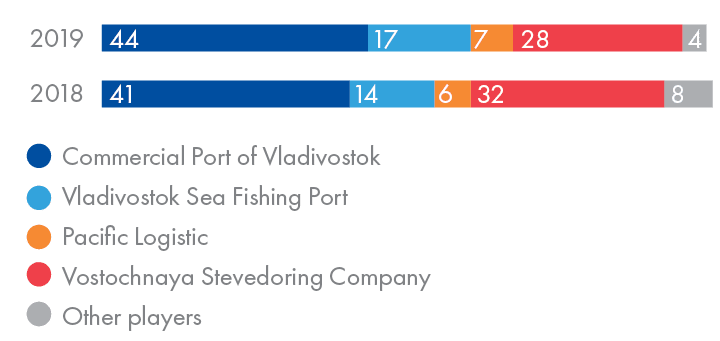

In 2019, container handling in key ports of the Primorye Territory increased by 6% to 1.4 million TEU vs 1.3 million TEU in 2018. VMTP demonstrated the biggest growth among its peers in the Primorye Territory – its cargo throughput went up by 13% to 625 million TEU vs 551 million TEU in 2018, taking the Port’s market share to 44%.

The Port Division owns and operates the Vladivostok container terminal, offering stevedoring, storage, warehouse lease and other port services. The port of Vladivostok benefits from convenient access to the Trans-Siberian Railway and road infrastructure.

VMTP is located in the north-west of Vladivostok, in the ice-free Golden Horn Bay of the Sea of Japan, making it navigable all year round. The port allows FESCO to capitalise on trade flows between Asia and Europe, providing transportation of containerised and general cargo.

With the area of 737,500 sq m, VMTP has 15 berths with a total length of 3.2 km and the maximum depth of 15 m. FESCO’s Port Division operates a diversified set of terminals in Vladivostok, including automobile, general cargo, oil and container terminals, and a refrigerated terminal.

VMTP’s annual handling capacities:

- 5.6 million tonnes – general cargo and oil products;

- 642 ktEU – containers.

The Port operates 49 cranes with lifting capacity varying from 16 to 100 tonnes, along with fork-lift trucks, tractors, reachstackers, front (bucket) loaders, empty container stackers.

As part of its equipment upgrade programme, VMTP signed agreements to procure:

- Liebherr LPS 420 portal crane with a lifting capacity of up to 124 t;

- four new Vityaz portal cranes with a lifting capacity of up to 63 t each and a maximum boom reach of up to 40 m. This machinery can handle various cargoes at the multi-purpose terminal. The new cranes will increase labour productivity, shorten loading and unloading times, and increase processing speeds by 15–20% over the current levels.

In 2019, the port motor fleet increased by 23 units, including terminal tractors, reachstackers, and new 46 t Sany fork-lift trucks that had never before been used at the ports of the Russian Far East.

On top of investing in equipment, VMTP repaired and reconstructed 71,000 sq m of road and berth pavements, thus increasing the warehouse area of the multi-purpose terminal.

As a multi-purpose port operator, VMTP handles a broad variety of cargo types, including containerised, LCL, bulk, and general cargo, cars and heavy-duty vehicles, as well as oil products.

The Port Division provides stevedoring, surveyor and freight forwarding services, including loading and discharging of vessels, railcars and trucks; transportation of cargo to storage facilities; sorting cargo; packing, changing the packaging and labelling cargo; storage; measuring and weighing cargo; preparation of documents in respect of cargo receipt and dispatch, port pilot services, forwarding and customs clearance.

The Port Division’s customers are large shipping companies, exporters and importers: East Metals AG, Siberian Anthracite, Maersk, CMA CGM, APL, Hyundai Merchant Marine Vladivostok, MMK Trading AG, Sinokor Merchant Marine and Korea Marine Transport.

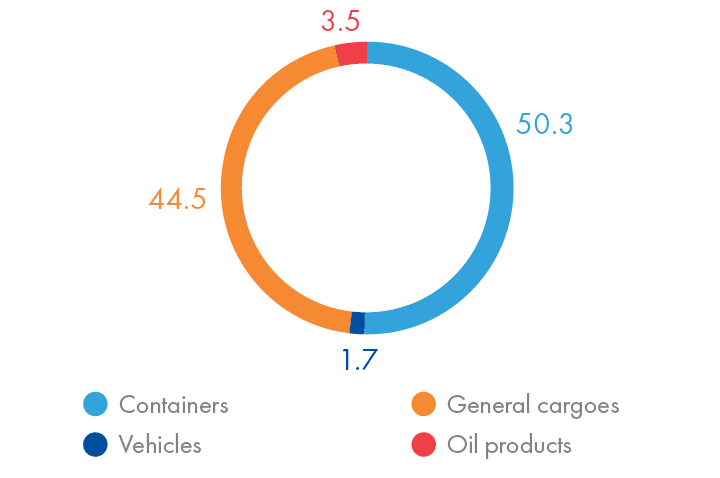

In 2019, VMTP improved all key operating indicators. Handling volumes reached an all-time high of 11.5 mt, exceeding the last year’s record by 10.5%. The increase occurred in all types of cargo.

| Indicators | 2016 | 2017 | 2018 | 2019 | YoY change, % |

|---|---|---|---|---|---|

| Container handling, ktEU | 330 | 468 | 551 | 625 | 13 |

| General cargoes handling, kt | 2,083 | 2,989 | 4,907 | 5,130 | 5 |

| Oil product handling, kt | 388 | 299 | 376 | 396 | 5 |

| Vehicle handling, ‘000 units | 25 | 38 | 60 | 77 | 28 |

Containers

VMTP’s share of the Far East’s handling market grew by 3 pp vs 2018 and reached a record 44%. The handling volume increased by 13% to a record 624,519 TEU vs 551,208 TEU in 2018. Handling of import and export cargoes showed the biggest growth of 17% due to higher volumes of both loaded and empty containers. Containers shipped domestically demonstrated 1% growth vs 2018.

General and bulk cargoes

Handling of bulk and general cargoes increased by 5%, to 5,130 thousand tonnes vs 4,907 thousand tonnes in 2018. Cast iron and construction materials showed significant growth, by 8% and 40% respectively, while the 52% decline in steel plates handling was offset by a 70% rise in slab handling.

Oil products

The petroleum tank farm of Commercial Port of Vladivostok processed 396 thousand tonnes of oil products, up by 5% vs 377 thousand tonnes in 2018.

Vehicles

Handling of vehicles and machinery increased by 27.6%, to 77,023 units vs 60,363 units in 2018. The growth was driven by high car demand in 2019 caused by the planned introduction of the Motor Vehicle Safety Certificate and attraction of new customers. In order to be able to handle the growing volumes, FESCO expanded the automobile terminal by leasing space from the multi-purpose terminal.

In 2019, VMTP handled a total of 2,009 vessels vs 1,989 vessels in 2018. Average daily fleet handling grew by 10.5% to 31.56 thousand tonnes vs 28.69 thousand tonnes in 2018. VMTP also handled 201 thousand units of rolling stock (+12%) vs 179 thousand units in 2018. Daily railcar handling reached 549 units vs 491 units in 2018.